Securus Data Property Fund Pte Ltd is a Singapore-resident Fund Company established by Keppel Telecommunications & Transportation (Keppel T&T) and AEP Investment Management (AEPim). AEPim and Keppel Data Centre Investment Management, (KDCIM), a wholly owned subsidiary of Keppel T&T are the Joint Investment Managers of Securus Fund with Keppel T&T and AEP Capital (AEPC) being the Fund sponsors (“Sponsors”).

Data Centre demand has been driven by the rapid rise of digitisation and the increasing importance of data with information-centric trends such as e-commerce, social networking and file sharing. Stringent data-related regulatory requirements and advancements such as cloud computing has especially increased the demand for quality Data Centre space.

The Securus Data Property Fund (Securus Fund) has been created to capitalise on this trend.

Each of the Sponsors has committed to seed equity in the Fund with Perbadanan Tabung Amanah Islam Brunei (TAIB) as the cornerstone investor of the Fund (“Cornerstone Investor”). The Fund is the world’s first Shariah-compliant data centre fund that combines the principles of Shariah capital with Singapore management expertise.

Investment Objective & Strategy

The Fund aims to generate opportunistic returns by investing in a high quality portfolio of income yielding wholesale Data Centre assets across its target markets, namely Asia-Pacific, Europe and the Middle East. It seeks to provide Investors with regular and stable distributions and achieve long term growth in the Funds Net Asset Value.

Fund Structure

The Fund is closed-ended and has been awarded the status of a Singapore Enhanced Tier Fund.

Having achieved its Initial Closing of US$100m on 7 June 2010, the Fund plans to raise further capital as required to support its growth plans

Joint Investment Managers

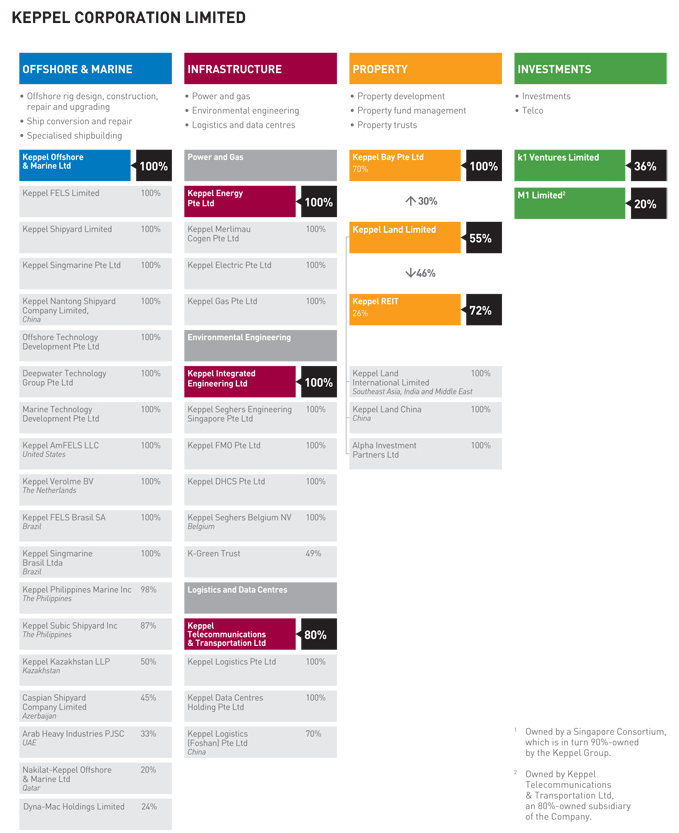

- Keppel T&T, 80%-owned by Keppel Corporation Ltd, is focused on Data Centre & Networks and Logistics Business (www.keppeltt.com.sg). Keppel T&T has:

- Substantial data centre space in Europe & Singapore which it owns and operates

- Experiences in the development of both greenfield and brownfield Data Centres

- Track record in delivering zero downtime over several years

- Focus on Tier III & Tier IV Data Centres

- Portfolio of blue chip tenants which include world’s largest Internet,

- IT and telecommunication companies, as well as public sector agencies

- Listing on SGX (ticker: k11)

- Keppel Corporation Ltd is a multinational company with a global presence spanning more than 30 countries engaging in Offshore and Marine, Property & Infrastructure and Investments Businesses (www.kepcorp.com)

- AEPim is a successful private equity real estate investment company based in Singapore which is 80%-owned by the Al Rajhi Holding Group(Saudi Arabia)(). It has:

- Excellent international fund management experience

- Proven real estate, financing and structuring capabilities

- Successful track record outperforming market benchmarks in previous investments

- Strong investor base – both Islamic and conventional investors

- The Al Rajhi Holding Group is one of the most respected and largest conglomerates in the Middle East. The Al Rajhi family founded and own the majority stake in the Al Rajhi Bank (ticker: RJHI AB), the largest Islamic Bank (by market cap) globally. ()

Securus Data Property Fund - 18 Cross Street #10-10

Marsh & McLennan Centre

China Square Central

Singapore 048423

Tel:

Fax:

Email: